04-16-2019, 09:30 AM

04-16-2019, 09:30 AM

|

#41

|

|

Who's askin'?

Join Date: Mar 2018

Location: Utah

Posts: 2,448

|

Quote:

Originally Posted by Perfectlap

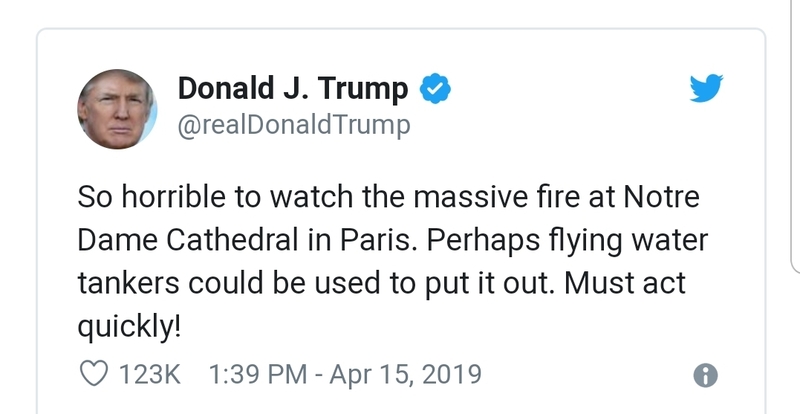

on this day April 15, 2019 President Trump provided stressed out tax filers this beauty

A GENIUS!

HE'S here all week folks.

|

Yeah, most of us wish he'd shut-down his twitter account.

And I would prefer he not speak to cameras, either.

I miss the real statesmen who used to run for President; Reagan. Kennedy. Hell, even Carter was better than anyone who's gained the nomination from either party in a LONG time.

I wish I'd been given a chance to vote for someone I WANTED to vote for.... instead of having to hold my nose in the booth.

|

|

|

04-16-2019, 04:11 PM

04-16-2019, 04:11 PM

|

#42

|

|

Registered User

Join Date: Oct 2007

Location: Midwest

Posts: 1,746

|

I hear the guys on Rennlist really miss you PL...........

Last edited by coreseller; 04-16-2019 at 05:10 PM.

|

|

|

04-16-2019, 05:18 PM

04-16-2019, 05:18 PM

|

#43

|

|

Registered User

Join Date: Nov 2004

Location: New Jersey

Posts: 8,709

|

Quote:

Originally Posted by maytag

Yeah, most of us wish he'd shut-down his twitter account.

And I would prefer he not speak to cameras, either.

I miss the real statesmen who used to run for President; Reagan. Kennedy. Hell, even Carter was better than anyone who's gained the nomination from either party in a LONG time.

I wish I'd been given a chance to vote for someone I WANTED to vote for.... instead of having to hold my nose in the booth.

|

there is hardly a day that goes by when Trump says something Trumpy and I don't immediately think "what would Ronald W. Reagan have done in this situation that 9 times out of 10 both furthered conservative ideals and reminded everyone why he was the only Republican the majority of Democrats trusted (being that he carried every single Democrat state but one even though they denied his party control of the Congress). Every Democrat state but one... I think his version of tax "reform" would have looked very different today. Ditto for immigration reform, his response to these mass shootings and certainly all this praise for a dictator/gangster running the second largest nuclear arsenal.

When Regan's head hit that pillow every night you knew he believed what he was saying. And he had no need to convince everyone that he was the smartest guy in the room or felt it necessary to put people down with petty personal insults. Humility and rational thought.

__________________

GT3 Recaro Seats - Boxster Red

GT3 Aero / Carrera 18" 5 spoke / Potenza RE-11

Fabspeed Headers & Noise Maker

BORN: March 2000 - FINLAND

IMS#1 REPLACED: April 2010 - NEW JERSEY -- LNE DUAL ROW

Last edited by Perfectlap; 04-16-2019 at 05:27 PM.

|

|

|

04-16-2019, 05:27 PM

04-16-2019, 05:27 PM

|

#44

|

|

NewUserName

Join Date: Oct 2018

Location: Delaware

Posts: 101

|

Quote:

Originally Posted by Perfectlap

on this day April 15, 2019 President Trump provided stressed out tax filers this beauty

A GENIUS!

HE'S here all week folks. |

He puts the TWIT in Twitter....

|

|

|

04-16-2019, 05:30 PM

04-16-2019, 05:30 PM

|

#45

|

|

Registered User

Join Date: Nov 2004

Location: New Jersey

Posts: 8,709

|

Quote:

Originally Posted by coreseller

I hear the guys on Rennlist really miss you PL...........

|

yes I hear things have gotten far more civil and fact based in the era of Trump.

__________________

GT3 Recaro Seats - Boxster Red

GT3 Aero / Carrera 18" 5 spoke / Potenza RE-11

Fabspeed Headers & Noise Maker

BORN: March 2000 - FINLAND

IMS#1 REPLACED: April 2010 - NEW JERSEY -- LNE DUAL ROW

|

|

|

04-17-2019, 03:39 PM

04-17-2019, 03:39 PM

|

#46

|

|

Registered User

Join Date: Oct 2007

Location: Midwest

Posts: 1,746

|

Apparently you're a legend over there. Good luck with your taxes, we all get screwed. As an S Corp owner mine went up 60%, Welcome to the USA lol.

|

|

|

04-18-2019, 09:06 AM

04-18-2019, 09:06 AM

|

#47

|

|

Registered User

Join Date: Nov 2004

Location: New Jersey

Posts: 8,709

|

Quote:

Originally Posted by coreseller

Apparently you're a legend over there. Good luck with your taxes, we all get screwed. As an S Corp owner mine went up 60%, Welcome to the USA lol.

|

less a legend. more like a Gatling gun.

although debunking alternative facts doesn't require anything but wire cutter ammo.

my effective rate went up but it didn't go up 60%.

that's absurd!!!!!

__________________

GT3 Recaro Seats - Boxster Red

GT3 Aero / Carrera 18" 5 spoke / Potenza RE-11

Fabspeed Headers & Noise Maker

BORN: March 2000 - FINLAND

IMS#1 REPLACED: April 2010 - NEW JERSEY -- LNE DUAL ROW

|

|

|

04-18-2019, 01:57 PM

04-18-2019, 01:57 PM

|

#48

|

|

Registered User

Join Date: Oct 2007

Location: Midwest

Posts: 1,746

|

Quote:

Originally Posted by Perfectlap

less a legend. more like a Gatling gun.

although debunking alternative facts doesn't require anything but wire cutter ammo.

my effective rate went up but it didn't go up 60%.

that's absurd!!!!!

|

The rate did not go up, the amount did. S-Corp owners get raped / I mean taxed on retained earnings, the income tax debt passes through to the owners.

|

|

|

04-18-2019, 02:54 PM

04-18-2019, 02:54 PM

|

#49

|

|

Registered User

Join Date: Sep 2016

Location: Central Ohio

Posts: 415

|

__________________

2000 Ocean Blue Boxster S

1980 Ferrari 308 GTSi

2019 Alfa Romeo Giulia Ti Sport AWD

|

|

|

04-19-2019, 05:49 AM

04-19-2019, 05:49 AM

|

#50

|

|

Registered User

Join Date: Aug 2009

Posts: 1,466

|

Here was my take on it. I got no refund. I ended up owing a little over $200. I made $1066 less this year than last year. Tax I owed in 2018 was $12651. Tax I owed in 2019 was $6590. So what I had was $6061 to spend through the course of the year. That comes out to $233 per pay split between my wife and myself. How is that not a windfall for the economy. By the way, I owed $1800 to the IRS last year at tax time.

__________________

2003 Black 986. modified for Advanced level HPDE and open track days.

* 3.6L LN block, 06 heads, Carrillo H rods, IDP with 987 intake, Oil mods, LN IMS. * Spec II Clutch, 3.2L S Spec P-P FW. * D2 shocks, GT3 arms & and links, Spacers front and rear * Weight reduced, No carpet, AC deleted, Remote PS pump, PS pump deleted. Recaro Pole position seats, Brey crouse ext. 5 point harness, NHP sport exhaust

|

|

|

04-19-2019, 08:15 AM

04-19-2019, 08:15 AM

|

#51

|

|

Racer Boy

Join Date: Sep 2015

Location: Seattle, WA

Posts: 946

|

Quote:

Originally Posted by jsceash

That comes out to $233 per pay split between my wife and myself. How is that not a windfall for the economy.

|

Short term, it may well be a windfall for the economy. Long term, what about the gigantic deficits created by the lower tax revenues?

For me, the biggest problem with the tax plan was that the IRS lowered withholdings without letting anyone know. I'm one of the lucky few who's tax rate actually increased (a very small percentage got screwed, and lucky me, I'm one of them!), but my withholding was decreased, so I ended up owing a lot more. In fact, since I didn't withhold enough, I also got socked with a nearly $900 penalty. I think Trump is a venal, dangerous, toxic nitwit, but my feelings toward him dipped even more when I wrote out the check for over $8000 to the IRS.

|

|

|

04-19-2019, 11:21 AM

04-19-2019, 11:21 AM

|

#52

|

|

Registered User

Join Date: Nov 2004

Location: New Jersey

Posts: 8,709

|

Quote:

Originally Posted by jsceash

Here was my take on it. I got no refund. I ended up owing a little over $200. I made $1066 less this year than last year. Tax I owed in 2018 was $12651. Tax I owed in 2019 was $6590. So what I had was $6061 to spend through the course of the year. That comes out to $233 per pay split between my wife and myself. How is that not a windfall for the economy. By the way, I owed $1800 to the IRS last year at tax time.

|

^ if you pay taxes federally with an actual comma in the figure and two digits before it but ARE NOT collecting a million plus in annual salary, then welcome... the bar is in the back. But I must advise you that If you saw a net reduction of 50% under this tax "reform" then you may not want to bring that up to the other members at the annual dinner.

it's great for the economy when everyone wins. if that's not possible then fairness would dictate that we either all feel an equal pinch or an equal consideration. it's easy principle to get behind

unless people realllly high up the income ladder who are very involved in dark money fookery know what strings to pull make sure they get the lion's share of the breaks and push the inescapable increases on the guys who actually have a mortgage and family medical bills to pay for.

is you having more income good for the economy? of course but you aren't a typical case study for a net payer of federal income tax where that tax represents a significant share of the household income.

And the big herd of elephants in the room is that net effect of this tax "reform" has undoubtedly put us ALL closer to higher interest rates. These new Trump era $1 trillion dollar deficits EACH YEAR for the next decade (a multiyear high water mark that's never been hit before) as a consequence of giving out tax breaks like we're in the days of the1990's budget surplus does NOT suspend the laws of supply and demand. We'll now need to sell two and three times the usual debt to our foreign creditors. higher interest rates are NOT great for an economy that runs disproportionately on people spending money they dont have or buying big ticket items like houses and autos. Tax Revenues falling off a cliff when spending is controlled by Trump, Mike Tyson, Curt Shilling, pro athlete financial planning has only one outcome. Keep plenty of cash on hand.

__________________

GT3 Recaro Seats - Boxster Red

GT3 Aero / Carrera 18" 5 spoke / Potenza RE-11

Fabspeed Headers & Noise Maker

BORN: March 2000 - FINLAND

IMS#1 REPLACED: April 2010 - NEW JERSEY -- LNE DUAL ROW

Last edited by Perfectlap; 04-19-2019 at 11:24 AM.

|

|

|

04-19-2019, 12:30 PM

04-19-2019, 12:30 PM

|

#53

|

|

Registered User

Join Date: Dec 2012

Location: FL

Posts: 4,145

|

Quote:

Originally Posted by Racer Boy

...but my withholding was decreased, so I ended up owing a lot more. In fact, since I didn't withhold enough, I also got socked with a nearly $900 penalty.

|

That happened to me one year when I did a lot of contracting and I owed around $5000 extra at tax time. There would have been an underpayment penalty, but since I hadn't manually decreased my withholding from the previous year, there was no penalty for underpaying for *that* year, but I had to increase my withholding for the following year or I would get a penalty next year. So maybe, since this occurred with no changes by you, you can get out of it?

|

|

|

04-19-2019, 02:29 PM

04-19-2019, 02:29 PM

|

#54

|

|

Racer Boy

Join Date: Sep 2015

Location: Seattle, WA

Posts: 946

|

I'll look into it, Steve. That's good information.

We didn't actually finish our taxes since TurboTax has a glitch that we couldn't overcome (I'll never use them again), so I just filed for an extension and paid what will likely be the final number.

|

|

|

04-19-2019, 06:09 PM

04-19-2019, 06:09 PM

|

#55

|

|

Registered User

Join Date: Dec 2012

Location: FL

Posts: 4,145

|

Quote:

Originally Posted by Racer Boy

I'll look into it, Steve. That's good information.

We didn't actually finish our taxes since TurboTax has a glitch that we couldn't overcome (I'll never use them again), so I just filed for an extension and paid what will likely be the final number.

|

Good luck! Maybe turbo tax doesn't handle that specific scenario? $900 would buy lots of car goodies for the Boxster!

|

|

|

04-22-2019, 06:48 PM

04-22-2019, 06:48 PM

|

#56

|

|

Registered User

Join Date: Jan 2019

Location: PA

Posts: 1,726

|

Quote:

Originally Posted by maytag

Particlewave, I'm not on about state taxes. I'm talking only about the feds. All of my usual deductions are gone. And they cut the standard deduction in half. I appreciate the effort at simplifying, but it didn't help me on the tax-liability front.

On the other hand: it's nice to see my investment accounts on the up. A Republican in the white house House always good for the economy.

Sent from my SM-G970U using Tapatalk

|

Clinton turned the Reagan/Bush recession into the roaring 90's and turned the then-biggest deficit into a surplus. W turned it back to the biggest deficit in history and the biggest recession since the Great Depression. Obama tripled my investment accounts after W decimated them, and gave us 80 months of consecutive job growth. Q3 2018 was the worst quarter in 10 years. I predict things will be going downhill again within the next 12 months. Mark my word.

Still think a Republican is good for the economy? LMAO!

|

|

|

04-23-2019, 04:50 AM

04-23-2019, 04:50 AM

|

#58

|

|

1998 Boxster Silver/Red

Join Date: Sep 2017

Location: 92262

Posts: 3,103

|

Quote:

Originally Posted by Perfectlap

You know not that this isn't anything you haven't been told your whole life, but insulting people that you feel intellectually superior to doesn't make you look any smarter. If anything it probably confirms their opinions of you. If you lack the ability to engage in simple debate without resorting to ad hominem then you are correct in staying exactly where you are.

|

Trump 2020?

__________________

1998 Porsche Boxster

|

|

|

04-23-2019, 07:40 AM

04-23-2019, 07:40 AM

|

#59

|

|

Registered User

Join Date: Jan 2014

Location: New Jersey

Posts: 1,631

|

I'm a NJ resident and try to be philosophical about taxes. If I'm paying taxes, it means I'm making money. The thing about states with high state income taxes is that they also tend to have high property taxes in the regions of these states where the high incomes are earned. And those property taxes are often times higher than the federal $10,000 deduction cap on state and local taxes all by themselves. And before the tax and mortgage interest deductions were put in place, I used to lose some of those deductions through both the deduction phase-out and the Alternative Minimum Tax, AMT or the government's ATM. High class problems, I know! We make our choices about where we want to live for a variety of reasons. One thing we can probably all agree on is that the federal tax system should be fair to all so that all individuals and corporations pay their fair share. Getting to agreement on what is "fair" is difficult, if not impossible!

|

|

|

04-28-2019, 10:15 AM

04-28-2019, 10:15 AM

|

#60

|

|

1998 Boxster Silver/Red

Join Date: Sep 2017

Location: 92262

Posts: 3,103

|

Remember the good old days when you could write off your credit card interest?

Oh... and **************** democrats. They hate America.

__________________

1998 Porsche Boxster

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is On

|

|

|

All times are GMT -8. The time now is 01:25 PM.

| |